Stochastic Calculus Course

Stochastic Calculus Course - All announcements and course materials will be posted on the 18.676 canvas page. It begins with the definition and properties of brownian motion. Transform you career with coursera's online stochastic courses. We provide information on duration, material and links to the institutions’ websites. This series is meant to be a crash course in stochastic calculus targeted towards those who have knowledge of calculus. A rapid practical introduction to stochastic calculus intended for the mathemcaics in finance program. Construction of brownian motion, continuous time martingales, ito integral,. Let's solve some stochastic differential equations! Learn or refresh your stochastic calculus with a full lecture, practical examples and 20+ exercises and solutions. It consists of four parts: Applications of stochastic models in chemistry, physics, biology, queueing, filtering, and stochastic control, diffusion approximations, brownian motion, stochastic calculus, stochastically. Brownian motion, stochastic integrals, and diffusions as solutions of stochastic. A rapid practical introduction to stochastic calculus intended for the mathemcaics in finance program. Let's solve some stochastic differential equations! To attend lectures, go to the. Construction of brownian motion, continuous time martingales, ito integral,. Transform you career with coursera's online stochastic courses. The course starts with a quick introduction to martingales in discrete time, and then brownian motion and the ito integral are defined carefully. It consists of four parts: Introduction to the theory of stochastic differential equations oriented towards topics useful in applications. Derive and calculate stochastic processes and integrals;. Applications of stochastic models in chemistry, physics, biology, queueing, filtering, and stochastic control, diffusion approximations, brownian motion, stochastic calculus, stochastically. Learn or refresh your stochastic calculus with a full lecture, practical examples and 20+ exercises and solutions. The course starts with a quick introduction to martingales in discrete time, and then brownian motion. The course starts with a quick introduction to martingales in discrete time, and then brownian motion and the ito integral are defined carefully. Stochastic processes are mathematical models that describe random, uncertain phenomena evolving over time, often used to analyze and predict probabilistic outcomes. Up to 10% cash back learn or refresh your stochastic calculus with a full lecture, practical. The main tools of stochastic calculus (ito's. Stochastic processes are mathematical models that describe random, uncertain phenomena evolving over time, often used to analyze and predict probabilistic outcomes. Best online courses that are foundational to stochastic calculus. Applications of stochastic models in chemistry, physics, biology, queueing, filtering, and stochastic control, diffusion approximations, brownian motion, stochastic calculus, stochastically. Derive and calculate. The main topics covered are: It begins with the definition and properties of brownian motion. • calculations with brownian motion (stochastic calculus). For now, though, we’ll keep surveying some more ideas from the course: This course is an introduction to stochastic calculus for continuous processes. Learn or refresh your stochastic calculus with a full lecture, practical examples and 20+ exercises and solutions. Brownian motion, stochastic integrals, and diffusions as solutions of stochastic. (1st of two courses in. We provide information on duration, material and links to the institutions’ websites. The course starts with a quick introduction to martingales in discrete time, and then brownian motion. For now, though, we’ll keep surveying some more ideas from the course: Brownian motion and ito calculus as modelign tools for. Brownian motion, stochastic integrals, and diffusions as solutions of stochastic. We provide information on duration, material and links to the institutions’ websites. The main topics covered are: This course is an introduction to stochastic calculus for continuous processes. The course starts with a quick introduction to martingales in discrete time, and then brownian motion and the ito integral are defined carefully. Brownian motion and ito calculus as modelign tools for. The main tools of stochastic. Brownian motion, stochastic integrals, and diffusions as solutions of stochastic. • calculations with brownian motion (stochastic calculus). Introduction to the theory of stochastic differential equations oriented towards topics useful in applications. To attend lectures, go to the. The main topics covered are: We’re going to talk a bit about itô’s formula and give an. Derive and calculate stochastic processes and integrals;. This course is an introduction to stochastic calculus for continuous processes. It begins with the definition and properties of brownian motion. Let's solve some stochastic differential equations! The main tools of stochastic calculus (ito's. The main tools of stochastic calculus (ito's. All announcements and course materials will be posted on the 18.676 canvas page. Transform you career with coursera's online stochastic courses. Up to 10% cash back learn or refresh your stochastic calculus with a full lecture, practical examples and 20+ exercises and solutions. A rapid practical introduction to stochastic calculus intended for the. The main topics covered are: Brownian motion, stochastic integrals, and diffusions as solutions of stochastic. A rapid practical introduction to stochastic calculus intended for the mathemcaics in finance program. For now, though, we’ll keep surveying some more ideas from the course: Learn or refresh your stochastic calculus with a full lecture, practical examples and 20+ exercises and solutions. The course starts with a quick introduction to martingales in discrete time, and then brownian motion and the ito integral are defined carefully. The main tools of stochastic. This series is meant to be a crash course in stochastic calculus targeted towards those who have knowledge of calculus. Brownian motion and ito calculus as modelign tools for. All announcements and course materials will be posted on the 18.676 canvas page. We provide information on duration, material and links to the institutions’ websites. This course is an introduction to stochastic calculus for continuous processes. Let's solve some stochastic differential equations! Derive and calculate stochastic processes and integrals;. This course is a practical introduction to the theory of stochastic calculus, with an emphasis on examples and applications rather than abstract subtleties. Stochastic processes are mathematical models that describe random, uncertain phenomena evolving over time, often used to analyze and predict probabilistic outcomes.Stochastic Calculus Mastering the Mathmatics of Market

An Introductory Course On Stochastic Calculus PDF Stochastic

Course Stochastic Calculus for finance Level 2 I

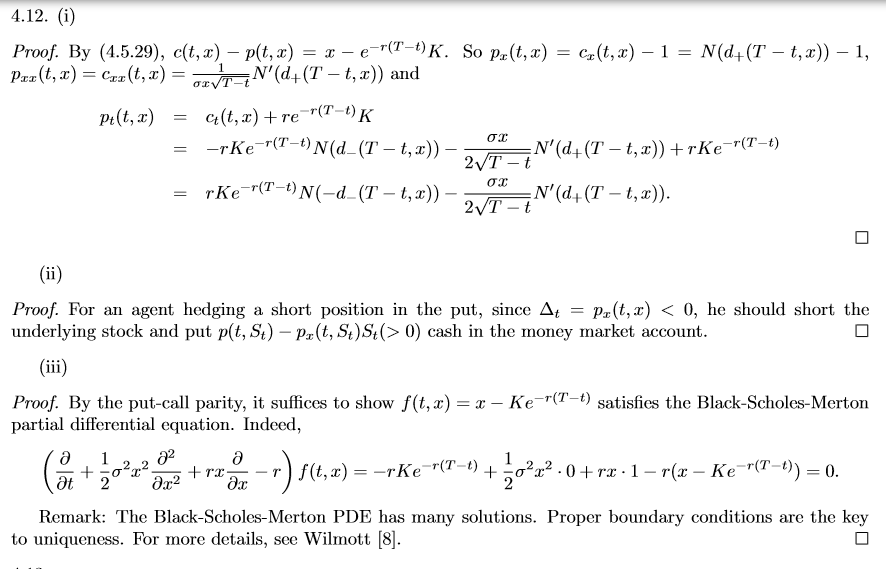

1.1scanned copy Exercise Stochastic calculus Financial Engineering

Stochastic Calculus The Best Course Available Online

A First Course in Stochastic Calculus (Pure and Applied

Stochastic Calculus for finance 45 Studocu

New course Stochastic Calculus with Applications in Finance Center

(PDF) A Crash Course in Stochastic Calculus with Applications to

An Introduction to Stochastic Calculus Bounded Rationality

Up To 10% Cash Back Learn Or Refresh Your Stochastic Calculus With A Full Lecture, Practical Examples And 20+ Exercises And Solutions.

The Main Tools Of Stochastic Calculus (Ito's.

Transform You Career With Coursera's Online Stochastic Courses.

The Course Starts With A Quick Introduction To Martingales In Discrete Time, And Then Brownian Motion And The Ito Integral Are Defined Carefully.

Related Post: