South Carolina Defensive Driving Course Insurance Discount

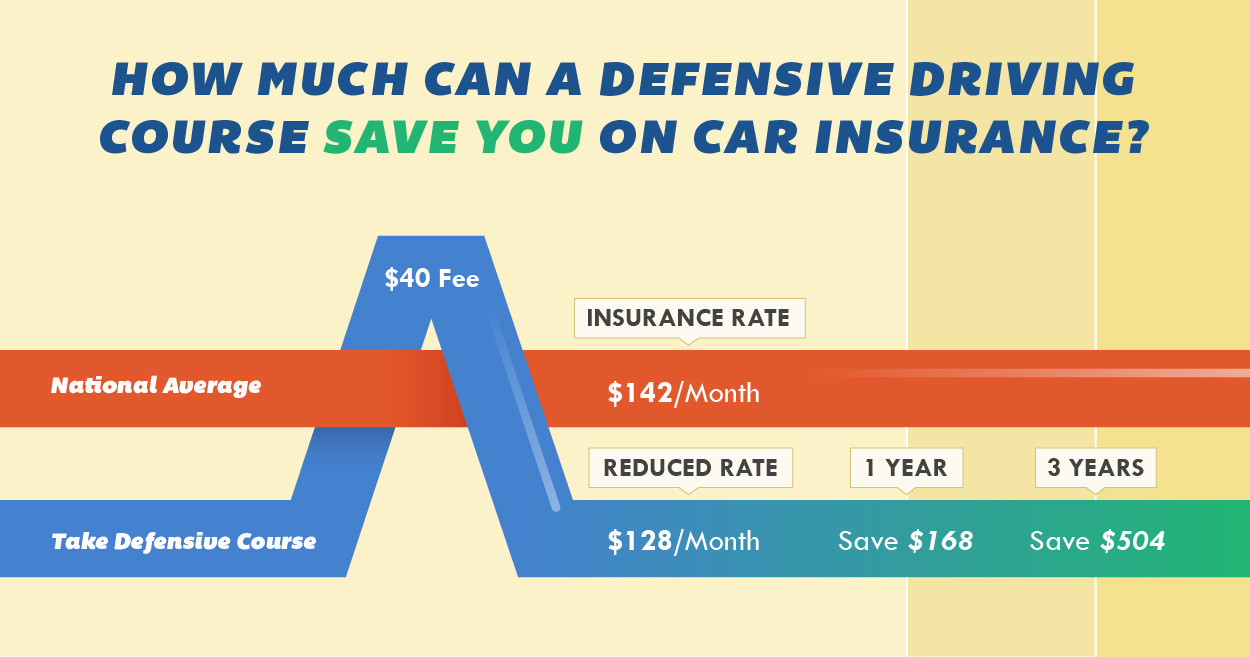

South Carolina Defensive Driving Course Insurance Discount - Register quick and easy online from any computer or mobile device in south. Car insurance after a dui in south carolina averages $2,988. Many insurance companies offer drivers discounts on auto insurance premiums if drivers complete a defensive driving course. Therefore, it is prudent to check first with your insurance company. Traffic school classes, also known as defensive driving courses, are taken after a traffic violation or citation, to adjust or prevent changes to driving record points, or as part of a court or legal. This course is included in our teen/ new driver course. Certificate is good for 3 years and can be used if you move to. Can i receive an auto insurance discount in south carolina for completing this course? Students will receive an insurance discount certificate upon completion of the insurance discount course. Drive safe & save puts you in the driver’s seat of your discount. Check with your auto insurance provider first to make sure they offer a. Many insurance companies offer drivers discounts on auto insurance premiums if drivers complete a defensive driving course. By taking this class online, you may qualify for the discount. While older motorists often qualify to benefit from this. Driver improvement program (a.k.a., defensive driving). Taken voluntarily, the course may also help you qualify for a hefty discount on your monthly insurance premiums. Car insurance after a dui in south carolina averages $2,988. Register quick and easy online from any computer or mobile device in south. Take this course if you are 55 or older to receive a discount on your auto insurance. Can i get my certificate. Progressive offers the cheapest dui car insurance on average. By taking this class online, you may qualify for the discount. Moreover, insurance companies vary in the nature and amount of the discount. Check with your auto insurance provider first to make sure they offer a. Take this course if you are 55 or older to receive a discount on your. You'll save with an initial discount just for signing up. While car insurance rates are rising across the country, south carolina still offers relatively affordable options. Lower car insurance rates after a dui by asking. We always recommend checking with your insurance provider to confirm the discount you can. Although some insurance providers offer a defensive driving discount, most reserve. While older motorists often qualify to benefit from this. However, you might be able to take a defensive driving class online in order to obtain a discount on your car insurance. Drivesafetoday provides the south carolina defensive driving course and traffic school online to help earn an insurance discount, dismiss citations, and fulfill court orders. Car insurance after a dui. By taking this class online, you may qualify for the discount. Tailored for point removal and insurance. Drivesafetoday provides the south carolina defensive driving course and traffic school online to help earn an insurance discount, dismiss citations, and fulfill court orders. The average annual cost for full coverage is $2,029, which is. While car insurance rates are rising across the. The cost of our insurance. After completing a defensive driving course in south carolina, many insurance companies will offer a discount on insurance premiums. Tailored for point removal and insurance. You'll save with an initial discount just for signing up. Many insurance companies offer drivers discounts on auto insurance premiums if drivers complete a defensive driving course. Traffic school classes, also known as defensive driving courses, are taken after a traffic violation or citation, to adjust or prevent changes to driving record points, or as part of a court or legal. Moreover, insurance companies vary in the nature and amount of the discount. Register quick and easy online from any computer or mobile device in south. Drivesafetoday. Most drivers who have completed the. Tailored for point removal and insurance. Register quick and easy online from any computer or mobile device in south. We always recommend checking with your insurance provider to confirm the discount you can. You'll save with an initial discount just for signing up. Although some insurance providers offer a defensive driving discount, most reserve this discount for older drivers.this discount varies by provider but typically ranges from 5% to. We always recommend checking with your insurance provider to confirm the discount you can. Car insurance after a dui in south carolina averages $2,988. In many cases, you can get an insurance discount by. Most drivers who have completed the. You'll save with an initial discount just for signing up. Drivesafetoday provides the south carolina defensive driving course and traffic school online to help earn an insurance discount, dismiss citations, and fulfill court orders. Certificate is good for 3 years and can be used if you move to. Students will receive an insurance discount. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. While older motorists often qualify to benefit from this. Certificate is good for 3 years and can be used if you move to. Most drivers who have completed the. By taking this class online, you may qualify for the discount. Traffic school classes, also known as defensive driving courses, are taken after a traffic violation or citation, to adjust or prevent changes to driving record points, or as part of a court or legal. Remove points from your driving record and keep insurance rates low with i drive safely's 100% online south carolina defensive driving course. Taken voluntarily, the course may also help you qualify for a hefty discount on your monthly insurance premiums. Check with your auto insurance provider first to make sure they offer a. Lower car insurance rates after a dui by asking. Therefore, it is prudent to check first with your insurance company. While car insurance rates are rising across the country, south carolina still offers relatively affordable options. Although some insurance providers offer a defensive driving discount, most reserve this discount for older drivers.this discount varies by provider but typically ranges from 5% to. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Most drivers who have completed the. Take our south carolina defensive driving course! Many insurance companies offer drivers discounts on auto insurance premiums if drivers complete a defensive driving course. However, you might be able to take a defensive driving class online in order to obtain a discount on your car insurance. Register quick and easy online from any computer or mobile device in south. Drive safe & save puts you in the driver’s seat of your discount. The cost of our insurance.Save Money On Car Insurance Defensive Driving Course From Debt To

South Carolina Defensive Driving Course SC DriveSafe Online®

4Hour South Carolina Defensive Driving Course Drive Safe SC

Defensive Driving Course

Defensive Driving Course SC Online to Save You Time and Money

Home Page Legit Course

Are Defensive Driving Courses Worth the Money? QuoteWizard

Defensive Driving South Carolina Online Course IMPROV

How Much Does a Defensive Driving Course Save on Insurance?

State Farm's Defensive Driving Discount What to Know The Wiser

Can I Get My Certificate.

You'll Save With An Initial Discount Just For Signing Up.

In Many Cases, You Can Get An Insurance Discount By Taking A Defensive Driving Or Traffic Safety Class.

This Course Is Included In Our Teen/ New Driver Course.

Related Post: