Real Estate Taxation Course

Real Estate Taxation Course - Comprehensive exam proving preparer's knowledge to receive credential. This course delves into the calculation of rental income, understanding the nuances of deductions, and unraveling the complexities of passive activity loss rules. For businesses that deal in real estate, navigating the tax landscape is a critical component of maximizing profitability and ensuring compliance. 20+ irs ce hours of education. This includes residential, commercial, and industrial properties. Learn the rules of real estate development; Learn everything you need to know about optimizing your taxes as a real estate investor. Explores taxation of personal trusts and estates; Explore the intricacies of federal income taxation as it intertwines with rental real estate activities. Learn how to calculate gain or loss on the sale of real estate; On monday, kane county treasurer chris lauzen announced that 2024 real estate tax bills for kane county residents, payable in 2025, will be in the mail on or before may 1. The key to real estate taxes: Understand the complex rules of depreciation, bonus depreciation, and section 179; Discover and implement tax strategies & loopholes that save real estate investors thousands of dollars every year! The only certification for real estate tax strategists Comprehensive exam proving preparer's knowledge to receive credential. At the chicago real estate institute you can become a licensed real estate agent or broker on your own terms. Learn how to attain the highest level of professional achievement by earning a designation in property tax, sales and use tax, state income tax, or credits and incentives. Explore the intricacies of federal income taxation as it intertwines with rental real estate activities. This course is designed for professionals working in the real estate industry interested in tax issues associated with real estate transactions. Demonstrate how this knowledge can increase the real estate agent's commission income and investment income. Learn the rules of real estate development; Over 10 hours of real estate specific content. Foundational courses drawn from across stern’s departments address real estate primary markets, real estate capital markets, real estate investment strategies, development and entrepreneurship, and real estate data science. Learn how. This course delves into the calculation of rental income, understanding the nuances of deductions, and unraveling the complexities of passive activity loss rules. What is a real estate agent? Comprehensive exam proving preparer's knowledge to receive credential. This course covers the tax consequences of various forms of financing real property purchases, the tax treatment of typical costs incurred when real. This course delves into the calculation of rental income, understanding the nuances of deductions, and unraveling the complexities of passive activity loss rules. Fiduciary rights, powers, and duties; The duration of real estate education can vary significantly depending on your chosen path. Explore the intricacies of federal income taxation as it intertwines with rental real estate activities. Explores taxation of. Tax strategy foundation is our most comprehensive tax course for real estate investors. Learn the rules of real estate development; The key to real estate taxes: Over 10 hours of real estate specific content. On monday, kane county treasurer chris lauzen announced that 2024 real estate tax bills for kane county residents, payable in 2025, will be in the mail. The only certification for real estate tax strategists At the chicago real estate institute you can become a licensed real estate agent or broker on your own terms. 20+ irs ce hours of education. Learn the rules of real estate development; This course covers the tax consequences of various forms of financing real property purchases, the tax treatment of typical. This includes residential, commercial, and industrial properties. Foundational courses drawn from across stern’s departments address real estate primary markets, real estate capital markets, real estate investment strategies, development and entrepreneurship, and real estate data science. For businesses that deal in real estate, navigating the tax landscape is a critical component of maximizing profitability and ensuring compliance. With ipt, you can. At the chicago real estate institute you can become a licensed real estate agent or broker on your own terms. Real estate property tax accounting involves the systematic recording and management of taxes levied on real estate properties. The only certification for real estate tax strategists Tax strategy foundation is our most comprehensive tax course for real estate investors. Foundational. Discover and implement tax strategies & loopholes that save real estate investors thousands of dollars every year! Comprehensive exam proving preparer's knowledge to receive credential. The only certification for real estate tax strategists Learn everything you need to know about optimizing your taxes as a real estate investor. You are required to complete 12. With ipt, you can know more and pro more. This course covers the tax consequences of various forms of financing real property purchases, the tax treatment of typical costs incurred when real property is purchased, and the tax treatment of expenses incurred when holding raw land. Join the over 10,000 other students who have found success with the best real. 20+ irs ce hours of education. This course delves into the calculation of rental income, understanding the nuances of deductions, and unraveling the complexities of passive activity loss rules. At the chicago real estate institute you can become a licensed real estate agent or broker on your own terms. What is a real estate agent? With ipt, you can know. The economic, legal, tax, and regulatory environments of real estate investment. The bs in real estate studies program is designed to provide the background required by employers in the real estate industry, while also providing the rigorous academic training needed for graduate study in real estate or finance. Foundational courses drawn from across stern’s departments address real estate primary markets, real estate capital markets, real estate investment strategies, development and entrepreneurship, and real estate data science. On monday, kane county treasurer chris lauzen announced that 2024 real estate tax bills for kane county residents, payable in 2025, will be in the mail on or before may 1. Real estate property tax accounting involves the systematic recording and management of taxes levied on real estate properties. Learn everything you need to know about optimizing your taxes as a real estate investor. The complexities of depreciation, entity structuring, 1031 exchanges, and passive activity rules demand expert guidance. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive course tailored for accountants. Learn the rules of real estate development; Understand the complex rules of depreciation, bonus depreciation, and section 179; Over 10 hours of real estate specific content. This course covers the tax consequences of various forms of financing real property purchases, the tax treatment of typical costs incurred when real property is purchased, and the tax treatment of expenses incurred when holding raw land. Discuss crts and how they can help avoid capital gains tax, increase income, and create tax deductions. Ongoing access to top real estate tax industry experts and resources to ensure you have all tools needed for your clients. This includes residential, commercial, and industrial properties. The key to real estate taxes:The Beginner’s Guide to Real Estate Taxation Renovated

Taxation of Real Estate Developers & JDA [Finance Act 2023] by Raj K

Certified Real Estate Tax Strateigst Credential™

The Beginner’s Guide to Real Estate Taxation Renovated

REAL Property Taxation REAL PROPERTY TAXATION Real Property Taxes

Fundamentals of Real Estate Taxation Capital gains, Property taxes

Mastering Real Estate Taxation LegaLees

Global real estate taxation guide Market Education

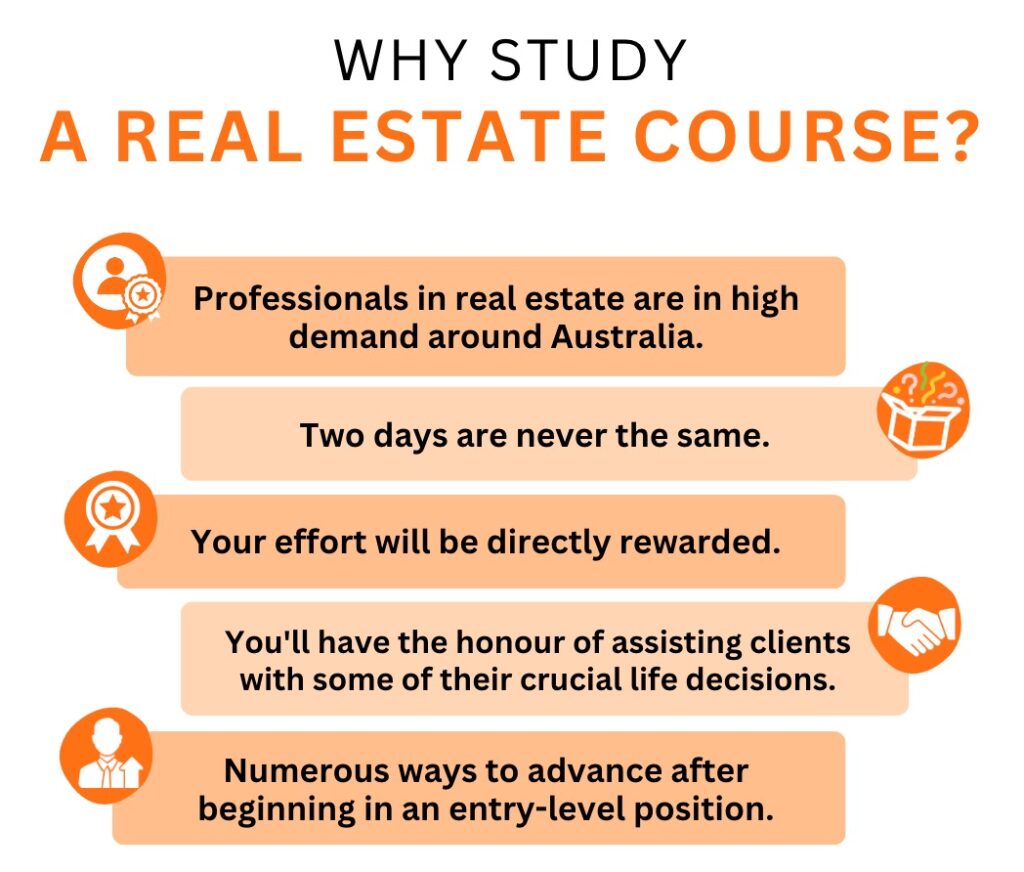

What Do You Learn in Real Estate Classes?

What Do You Learn in Real Estate Classes?

With Ipt, You Can Know More And Pro More.

The Duration Of Real Estate Education Can Vary Significantly Depending On Your Chosen Path.

Discover And Implement Tax Strategies & Loopholes That Save Real Estate Investors Thousands Of Dollars Every Year!

Comprehensive Exam Proving Preparer's Knowledge To Receive Credential.

Related Post:

![Taxation of Real Estate Developers & JDA [Finance Act 2023] by Raj K](https://ttpl.imgix.net/9789356227415L.jpg?w=1200)