How Much Does Defensive Driving Course Lower Insurance

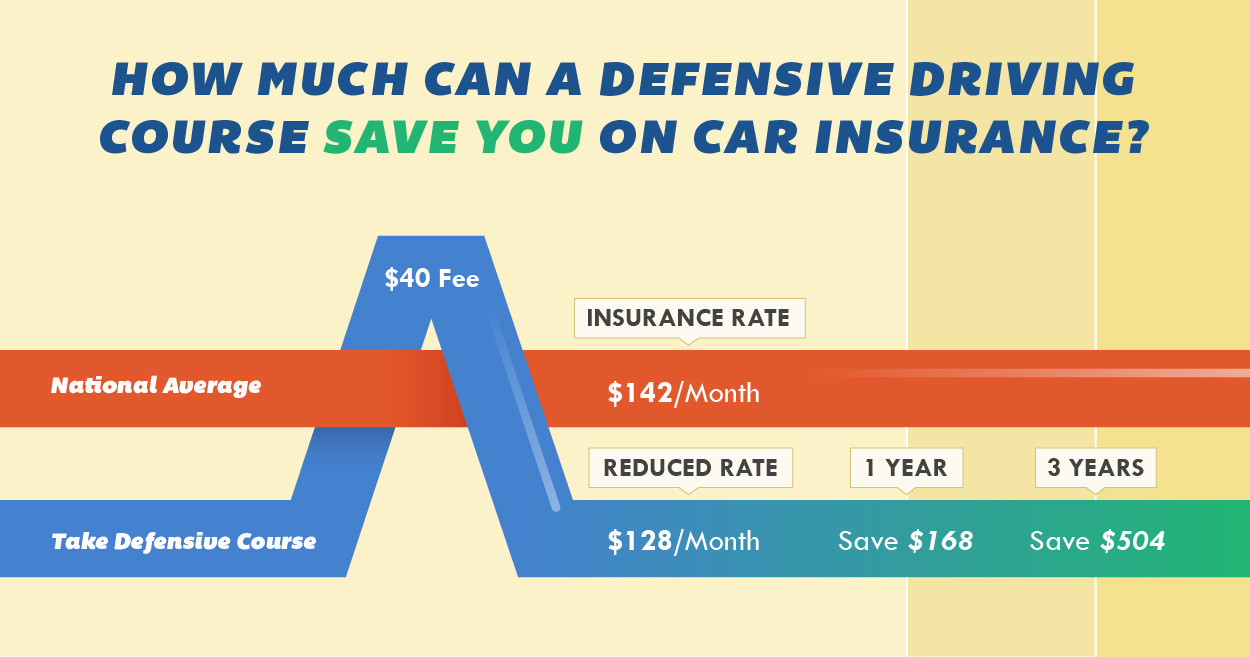

How Much Does Defensive Driving Course Lower Insurance - What is a defensive driving discount? Completing a defensive driving course can lead to substantial financial benefits. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Teens and seniors are often eligible for the discount, which can lower premiums by around 10%. While discounts vary by state and insurance provider, here’s what drivers typically receive:. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. Lower stress levels and avoid road rage; Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Drive safely in bad weather; In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. Insurance companies often view speeding violations as indicators of risky. Qualify for a defensive driving discount on car insurance; To qualify for a defensive driver car. Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. A defensive driving discount is a. Not only does defensive driving help you stay safe, but it. Completing a defensive driving course can lead to substantial financial benefits. The answer is that it depends! Some states require insurance companies to offer a. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Thus, they reward safe drivers with lower premiums. In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. Car insurance providers don’t want to pay claims if they don’t have to. Insurance companies often view speeding violations as indicators of risky. Many insurance providers offer significant auto insurance discounts if you complete a. The answer is that it depends! Completing a defensive driving course can lead to substantial financial benefits. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Often, illinois car insurance providers will offer. The discount varies but usually falls in the range of 5% to 20% off your. 5/5 (6,525 reviews) Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. To qualify for a defensive driver. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. Completing a defensive driving course can lead to significant savings on your auto insurance premiums. Car. To qualify for a defensive driver car. In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. What is a defensive driving discount? Completing a defensive driving course can lead to significant savings on your auto insurance premiums. The answer is that it depends! Qualify for a defensive driving discount on car insurance; Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Thus, they reward safe drivers with lower premiums. Lower stress levels and avoid road rage; Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Lower stress levels and avoid road rage; What is a defensive driving discount? Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course. Beyond savings, the course equips you with. In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. Completing a defensive driving course can lead to substantial financial benefits. We always recommend checking with your insurance provider to confirm the discount you can. Lower stress levels and avoid road rage; Often, illinois car insurance providers will offer a safe driver discount. Beyond savings, the course equips you with. Upon completion, many of our course takers have enjoyed reduced rates on their car insurance. The answer is that it depends! Car insurance providers don’t want to pay claims if they don’t have to. Teens and seniors are often eligible for the discount, which can lower premiums by around 10%. Lower stress levels and avoid road rage; A defensive driving discount is a. Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Completing a defensive driving course can lead to substantial financial benefits. Not only does defensive driving help you stay safe, but it. Drive safely in bad weather; Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. It allows reductions to rates and premium charges for automobile liability insurance for any insured driver over age 55 upon successful completion of the national safety council's. What is a defensive driving discount? How much do speeding tickets affect insurance? While discounts vary by state and insurance provider, here’s what drivers typically receive:. In illinois, a speeding ticket can lead to increased insurance premiums and potentially impact your driving record. A defensive driving course typically lasts six to eight hours. Car insurance providers don’t want to pay claims if they don’t have to. Beyond savings, the course equips you with. The discount varies but usually falls in the range of 5% to 20% off your. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. A defensive driving discount is a. Completing a defensive driving course can lead to significant savings on your auto insurance premiums. Often, illinois car insurance providers will offer a safe driver discount on premiums to drivers who voluntarily complete a defensive driving course. Many insurance providers offer significant auto insurance discounts if you complete a defensive driving course.Safe Driving Classes For Seniors Comparison + Details Traffic Safety

Save Money On Car Insurance Defensive Driving Course From Debt To

Are Defensive Driving Courses Worth the Money? QuoteWizard

How Much Does a Defensive Driving Course Save on Insurance?

How Much Does a Defensive Driving Course Save on Insurance?

How to Reduce Your Florida Insurance Premium with Defensive Driving

Does Taking a Defensive Driving Course Lower Insurance?

Does a defensive driving course lower your insurance costs?

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Thus, They Reward Safe Drivers With Lower Premiums.

So, Does Defensive Driving Lower Insurance?

To Qualify For A Defensive Driver Car.

Insurance Companies Often View Speeding Violations As Indicators Of Risky.

Related Post: