Ea Tax Preparer Course

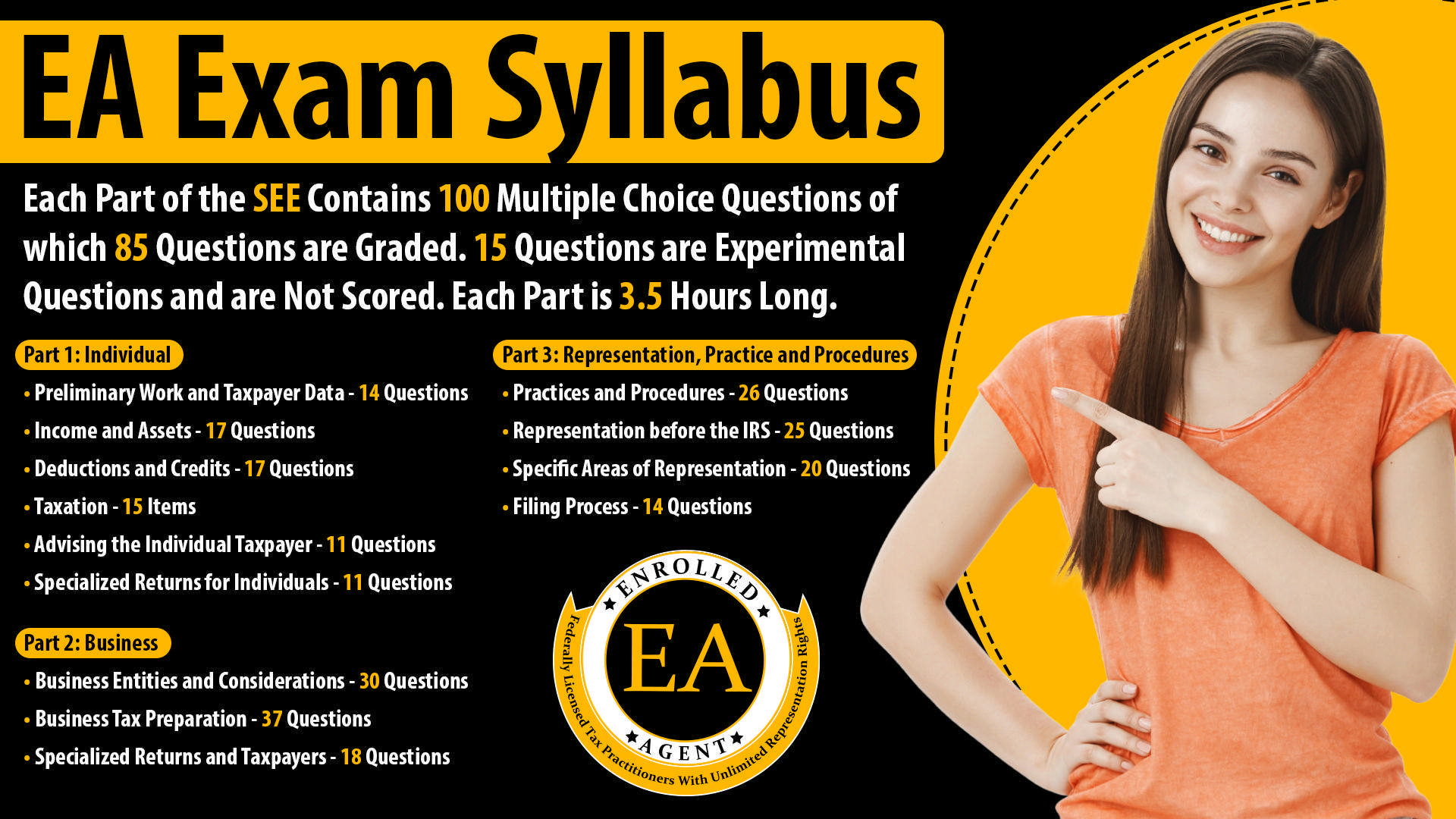

Ea Tax Preparer Course - Ea exam prep course, part 3, 2025, filing process. It can be challenging to choose the best ea review course or study guide that will enable you to pass the see exam and earn your enrolled agent certification as quickly as possible. Speed up your path to become an enrolled agent with three different plan options to help you succeed in passing the ea exam. To become an enrolled agent you have to take a 3 part exam with the irs. What is an enrolled agent? An enrolled agent (ea) is a highly qualified tax professional who has earned the legal. Increase your income and learn how to become an enrolled agent with our irs approved ea exam review course. The prices below reflect a 20% discount off the regular list. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). We’ve updated our entire ea video library with brand new gleim. As a tax professional, an ea has the authority to represent taxpayers. A ptin is a unique identification. Become an ea with gleim, the enrolled agent course tax preparers trust. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. The prices below reflect a 20% discount off the regular list. An enrolled agent (ea) is someone who has passed the enrolled agent exam and obtained an ea certification that identifies them as someone who is familiar enough with the tax code to. Free sample courseaccepted all 50 statesinstant accessirs approved An enrolled agent (ea) is a highly qualified tax professional who has earned the legal. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). It can be challenging to choose the best ea review course or study guide that will enable you to pass the see exam and earn your enrolled agent certification as quickly as possible. The certification entitles you to provide. Ea exam prep course, part 3, 2025, filing process. An enrolled agent (ea) is someone who has passed the enrolled agent exam and obtained an ea certification that identifies them as someone who is familiar enough with the tax code to. Many aspiring eas pursue formal education or specialized training programs to prepare for. Take the next step in your tax preparation career, and earn. Ea exam prep course, part 3, 2025, filing process. What is an enrolled agent? It can be challenging to choose the best ea review course or study guide that will enable you to pass the see exam and earn your enrolled agent certification as quickly as possible. This exam,. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. The prices below reflect a 20% discount off the regular list. Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs. To become an ea, you must meet specific educational requirements, including. Become an ea with gleim, the enrolled agent course tax preparers trust. If you choose the enrolled agent route, you can expect. Becoming an enrolled agent (ea) is a fantastic way to build a successful career in tax preparation and representation. This exam, known as the special enrollment exam, or see, covers. Speed up your path to become an enrolled. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). Become an ea with gleim, the enrolled agent course tax preparers trust. To become an enrolled agent you have to take a 3 part exam with the irs. It has everything you need to pass the enrolled agent exam, which is testable. Ea exam prep course, part 3, 2025, filing process. Refreshers, plus corporation, partnership, and trust tax training, and major bonuses. This is the fourth of 4 videos in the ea tax trai. If you choose the enrolled agent route, you can expect. We’ve updated our entire ea video library with brand new gleim. A ptin is a unique identification. We’ve updated our entire ea video library with brand new gleim. This is the fourth of 4 videos in the ea tax trai. What is an enrolled agent? Become an ea with gleim, the enrolled agent course tax preparers trust. A ptin is a unique identification. Take the next step in your tax preparation career, and earn. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. Prepare for, take, and pass the ea exam. We’ve updated our entire ea video library with brand new gleim. Pass the enrolled agent exam the first time. This is the fourth of 4 videos in the ea tax trai. An enrolled agent (ea) is a highly qualified tax professional who has earned the legal. Refreshers, plus corporation, partnership, and trust tax training, and major bonuses. Increase your income and learn how to become an enrolled agent with our irs. Refreshers, plus corporation, partnership, and trust tax training, and major bonuses. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. As a tax professional, an ea has the authority to represent taxpayers. Take the next step in your tax preparation career, and earn. The certification entitles you to provide. What is an enrolled agent? Increase your income and learn how to become an enrolled agent with our irs approved ea exam review course. Personalized contentaccurate & timely coursescredit hour variety A ptin is a unique identification. This is the fourth of 4 videos in the ea tax trai. An enrolled agent (ea) is someone who has passed the enrolled agent exam and obtained an ea certification that identifies them as someone who is familiar enough with the tax code to. Pass the enrolled agent exam the first time. Refreshers, plus corporation, partnership, and trust tax training, and major bonuses. It can be challenging to choose the best ea review course or study guide that will enable you to pass the see exam and earn your enrolled agent certification as quickly as possible. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). If you choose the enrolled agent route, you can expect. This exam, known as the special enrollment exam, or see, covers. Presented by tom norton cpa, ea. Free sample courseaccepted all 50 statesinstant accessirs approved Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs.How to be an Enrolled AgentScope and Benefit for Tax Professionals

an Enrolled Agent with Universal Accounting Training

Tax Formula. CPA/EA Exam. Tax Course YouTube

Tax & Accounting Training Manual Learn Tax Planning, Tax Resolution

Enrolled Agent Course (EA USA) Certification US tax Exam and Preparation

US Tax Representative Enrolled Agent (EA) IRS Approved Courses

Enrolled AgentUS Tax Expert iLead Tax Academy

EA Vs. CPA US Course Who Should do which? Uplift professionals

The Benefits of Enrolled Agent Certification for Tax Professionals

Why should a tax professional do EA? HiEducare

Becoming An Enrolled Agent (Ea) Is A Fantastic Way To Build A Successful Career In Tax Preparation And Representation.

Become An Ea With Gleim, The Enrolled Agent Course Tax Preparers Trust.

Apply To Become An Enrolled Agent, Renew Your Status And Irs Preparer Tax Identification Number (Ptin) And Learn About Continuing Education.

Many Aspiring Eas Pursue Formal Education Or Specialized Training Programs To Prepare For This Challenging Exam.

Related Post: