Credit Counseling Course Online For Chapter 7

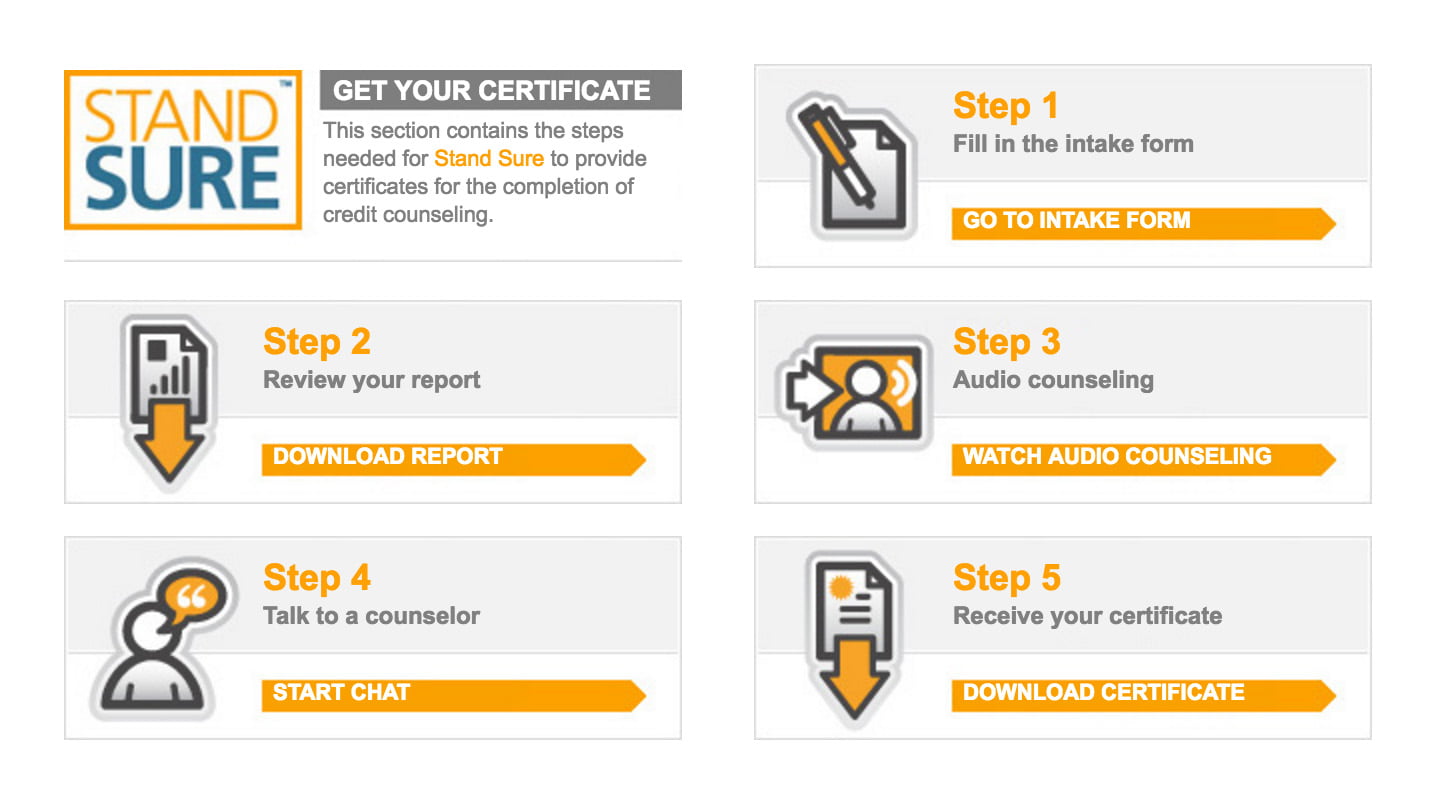

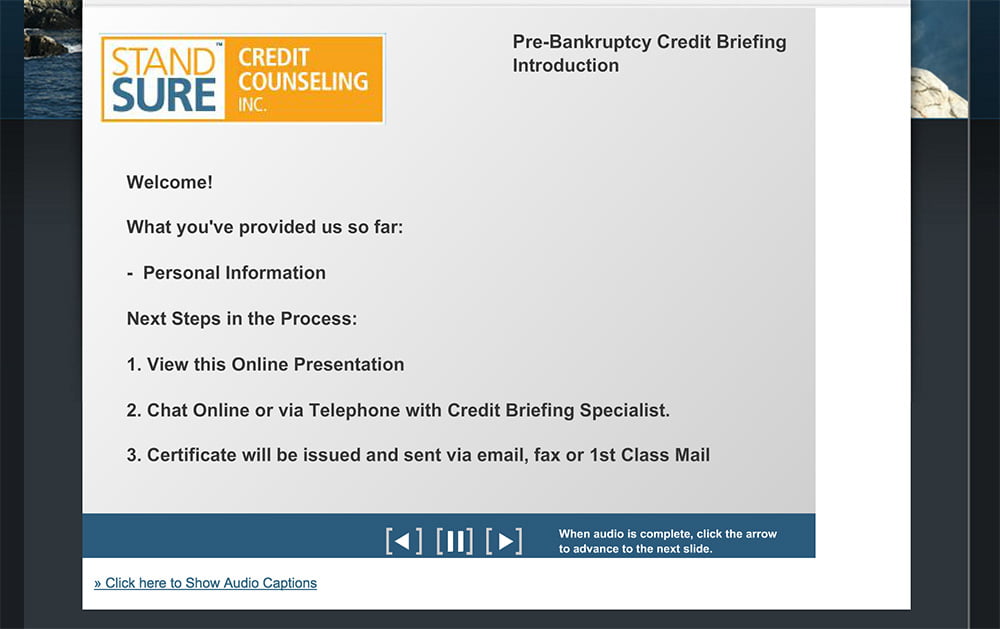

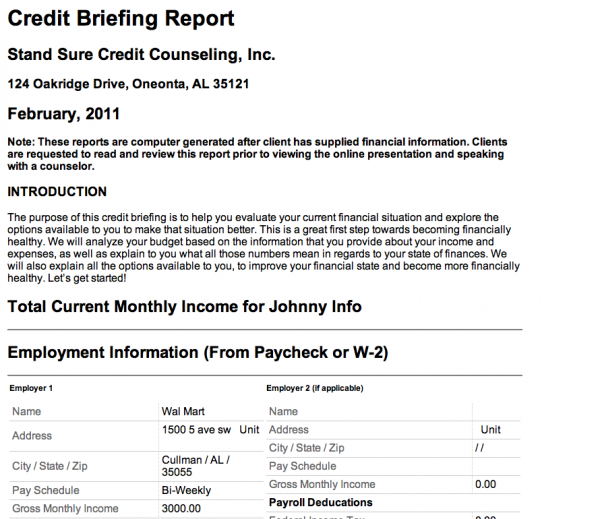

Credit Counseling Course Online For Chapter 7 - Receive your certificate immediately after completing the course. Once you are done with this part, you have a choice between communicating with your counselor via. Preparing for a chapter 7 filing involves verifying eligibility through income assessment and means testing, gathering comprehensive personal and financial documentation, and. Need help filing chapter 7? Start your free credit counseling session you can regain control of your money and peace of mind. No additional fees charged for completing. Bankruptcy credit counseling for bankruptcy filers, debtorcc.org is a u.s. Trusted industry resourcetop companieshighest ethical standardsfree consultations Mandated by the 2005 bankruptcy abuse protection and consumer. Trusted loan guidanceloan advice you can trustmedical expense loans Receive your certificate immediately after. Trusted loan guidanceloan advice you can trustmedical expense loans Find out the deadlines, exceptions, and how to fi… Mandated by the 2005 bankruptcy abuse protection and consumer. These may not be provided at the same time. Find out what information you. Before you can file bankruptcy, you must take a mandatory credit counseling course. No additional fees charged for completing. Start your free credit counseling session you can regain control of your money and peace of mind. Includes 24/7 access to the money in motion online course. Find out what information you. Trusted loan guidanceloan advice you can trustmedical expense loans Receive your certificate immediately after. Abacus credit counseling is an approved credit counseling agency, and sage personal finance is an approved debtor education provider.* together, we offer a convenient and affordable. Credit counseling must take place before you file for bankruptcy; Before you can file bankruptcy, you must take a mandatory credit counseling course. Relief for us residentsqualify w/o bankruptcyfor state residentsinclude multiple debts Debtor education must take place after you file. Includes 24/7 access to the money in motion online course. Find out the deadlines, exceptions, and how to fi… Before you can file bankruptcy, you must take a mandatory credit counseling course. Considering chapter 7 or 13 bankruptcy? Debtor education must take place after you file. Mandated by the 2005 bankruptcy abuse protection and consumer. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. These may not be provided at the same time. You'll need to complete the course in the six month (180. Debtor education must take place after you file. Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. Once you are done with this part, you have a choice between communicating with. Bankruptcy credit counseling for bankruptcy filers, debtorcc.org is a u.s. Includes 24/7 access to the money in motion online course. Credit counseling must take place before you file for bankruptcy; Start your free credit counseling session you can regain control of your money and peace of mind. No additional fees charged for completing. Abacus credit counseling is an approved credit counseling agency, and sage personal finance is an approved debtor education provider.* together, we offer a convenient and affordable. Receive your certificate immediately after completing the course. Trusted industry resourcetop companieshighest ethical standardsfree consultations Save your progress and return later; Includes 24/7 access to the money in motion online course. Bankruptcy credit counseling for bankruptcy filers, debtorcc.org is a u.s. Additionally includes a debtor education session with a certified credit counselor. Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. As per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13. Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. Once you are done with this part, you have a choice between communicating with your counselor via. Preparing for a chapter 7 filing involves verifying eligibility through income assessment and means testing, gathering comprehensive personal and financial documentation, and. Abacus credit counseling. Considering chapter 7 or 13 bankruptcy? If the cc course is not completed before filing, the case could be. Need help filing chapter 7? Credit counseling must take place before you file for bankruptcy; Save your progress and return later; As per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to complete a bankruptcy credit. You'll need to complete the course in the six month (180. Credit counseling must take place before you file for bankruptcy; No additional fees charged for completing. Receive your certificate immediately. These may not be provided at the same time. Considering chapter 7 or 13 bankruptcy? Credit counseling must take place before you file for bankruptcy; Start your free credit counseling session you can regain control of your money and peace of mind. Trusted industry resourcetop companieshighest ethical standardsfree consultations If the cc course is not completed before filing, the case could be. Debtor education must take place after you file. Find out the deadlines, exceptions, and how to fi… Before you can file bankruptcy, you must take a mandatory credit counseling course. No additional fees charged for completing. Save your progress and return later; Relief for us residentsqualify w/o bankruptcyfor state residentsinclude multiple debts Receive your certificate immediately after. Once you are done with this part, you have a choice between communicating with your counselor via. Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. Preparing for a chapter 7 filing involves verifying eligibility through income assessment and means testing, gathering comprehensive personal and financial documentation, and.How Credit Counseling Works Course) Stand Sure Counseling

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

How Credit Counseling Works Course) Stand Sure Counseling

How Does Online Credit Counseling Work? InCharge Debt Solutions

Everything You Need To Know About the Required Bankruptcy Courses

Completing Your Bankruptcy Credit Counseling Courses

Bankruptcy Counseling & Debtor Education Money Fit

How Credit Counseling Works Course) Stand Sure Counseling

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

Credit Counseling Chapter 7 in Michigan Mitten Law

Mandated By The 2005 Bankruptcy Abuse Protection And Consumer.

Trusted Industry Resourcetop Companieshighest Ethical Standardsfree Consultations

Need Help Filing Chapter 7?

As Per The Bankruptcy Abuse And Consumer Protection Act Of 2005 (Bapcpa), Consumers Who File A Chapter 7 Or Chapter 13 Bankruptcy Are Required To Complete A Bankruptcy Credit.

Related Post: